Speculation about the market as 10,000 BTC depart the wallet after nine years

In just two days, the price of bitcoin fell to new August lows, falling for the first time since mid-July below the $20K per unit zone. After nearly nine years of inactivity, two addresses created on December 19, 2013, delivered 10,000 bitcoin worth $203 million to unidentified wallets at that period. According to Onchain statistics, the 10,000 coins transferred this week were initially part of the Mt. Gox breach that took place on June 19, 2011.

This past weekend, when 5,000 BTC was included in a block, analysts initially noticed oddly high transaction volumes. The assets, whose owner is still unknown, have been kept in the same wallet since 2013. A day later, a nearly identical 5,000 BTC was added.

For the first time since 2013, 10,000 BTC moved in total, and on-chain sleuths are interested in the motivation of the whale in command.

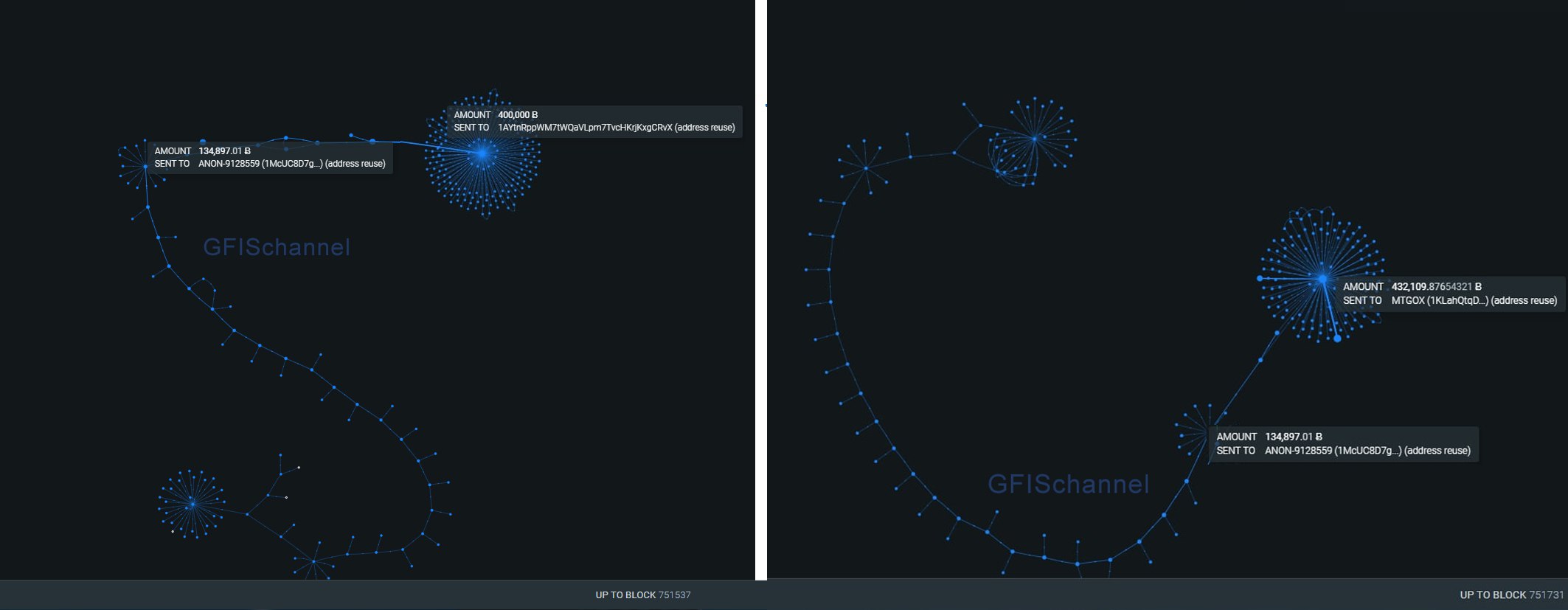

According to analysis of the destination wallets, the money was not transferred to an exchange to be traded. They were divided among a great many new wallets instead. The on-chain analytics tool CryptoQuant contributor Maartunn hypothesised that privacy might have been a factor in the choice.

The blockchain parser btcparser.com, a tool that frequently discovers so-called “sleeping bitcoins” moving after lying dormant in addresses for years, detected the 10,001 bitcoin transaction. Blockchain parsers have discovered several sleeping bitcoins that were mined in 2011, 2010, and 2009.

The transfers from June 2011 to the present reveal no evidence of an exchange, and the whale’s massive reserve of 134K BTC was steadily reduced over the course of the previous 11 years in fractions. The hoard coming from the original 1McUC address appears to have been used up, with the 10,001 BTC spent this week being the last.

🚨🚨 Another 5.000 $BTC moved one block ago. The #Bitcoin has the same age as yesterday (7y ~ 10y).

This makes it NO INCIDENT, but truelly a EXPERIENCED market participant who want to get OUT ❌ https://t.co/YqSHuAcAfU pic.twitter.com/GjtmH7yyNI

— Maartunn (@JA_Maartun) August 29, 2022

History of Bitcoin only contains six such transactions.

The transactions were also detected by Philip Swift, the inventor of the on-chain analytics tool LookIntoBitcoin, using the Whale Shadows indication.

The statistics sparked debate about their implications for the movement of the BTC price because it clearly showed the two spikes in older currencies taking place.

Swift and CryptoQuant demonstrated that earlier increases like this denoted regional highs for BTC/USD over the course of Bitcoin’s existence.

Other social media critics even made the claim that the monies were connected to Mt. Gox’s rehabilitation programme.

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.