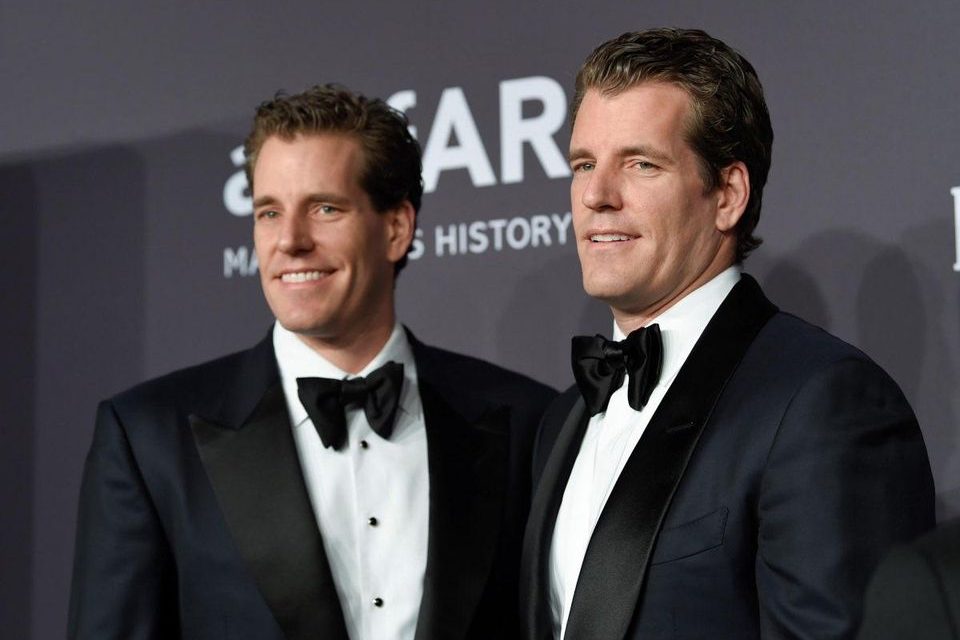

Cameron Winklevoss Proposes $1.4 Billion Deal in Effort to Resolve Conflict with DCG Founder Barry Silbert

In a bid to put an end to the ongoing dispute with Digital Currency Group (DCG) CEO Barry Silbert, Cameron Winklevoss, co-founder of Gemini, has offered a staggering $1.4 billion deal. Winklevoss took to Twitter on July 4 to announce the offer, describing it as the “best and final offer.”

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/ErsYpcEjQD

— Cameron Winklevoss (@cameron) July 4, 2023

Winklevoss, in addition to sharing the proposed deal, published an open letter addressed to Silbert. In the letter, he accused Silbert of engaging in deceptive practices, causing professional fees to skyrocket to over $100 million. Winklevoss emphasized that this prolonged conflict had come at the expense of creditors and users of Earn.

The Gemini co-founder’s letter was direct and uncompromising, stating,

“It takes a special kind of person to owe $3.3 billion dollars to hundreds of thousands of people and believe… that they are some kind of victim. Not even Sam Bankman-Fried was capable of such delusion.”

The ultimatum was clear: Silbert must accept the proposed deal by 4 PM ET on July 6, or potentially face legal action. The unfolding events between these prominent industry players have sparked curiosity about the outcome.

Under the terms of the proposed deal, DCG would absorb any payouts exceeding $300 million to the FTX and Alameda bankruptcy estates. Additionally, the Genesis bankruptcy estate expects DCG to contribute $100 million. DCG will retain all proceeds from the sale of Genesis Global Trading.

The deal comprises three types of payments: a forbearance payment and two debt tranches. The first payment, amounting to $275 million, is due on or before the Planned Support Agreement date of July 21. The first debt tranche of $355 million will be due two years from the PSA, while the second tranche of $835 million will be due five years from the PSA.

Lumida Wealth CEO, also engaged in the matter, tweeted about the ongoing discussion between Winklevoss and Silbert. However, he expressed doubt that DCG would meet the deadline.

DCG has faced significant challenges in recent months. In May, Gemini, led by Cameron Winklevoss, extended a $630 million loan to the company, which it failed to repay. The collapse of Silicon Valley Bank dealt a severe blow to DCG, forcing the company to seek new partners.

Authorities in the United States are reportedly investigating DCG for potential misconduct in its operations, focusing on internal transfers. The mounting difficulties have already led DCG to close its brokerage subsidiary, TradeBlock.

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.