Poloniex’s Guide for the Bear Market – 5 Best Investment Strategies to fight Inflation

In their latest article, Poloniex has shared a detailed guide to deal with the bear market along with 5 best investment strategies to fight inflation. Following are the 5 routes that Poloniex suggests are the ones to take in the bear market. These investment strategies can help you stay ahead of the inflation and ensure better yields.

Gold

Investing in gold is the traditional way to beat inflation. According to Forbes Advisor, gold has seen an average annual gain of 9.48% over the two decades between September 2001 and September 2021. Therefore, gold has long been regarded as a tool of good retaining value. As gold is valued in U.S. dollars, which gives it an advantage when the U.S. dollar falls in value. Although you can purchase gold bullion in the form of coins or bars from jewelry shops and banks, the storing and insuring processes will cost you additional costs so it is more advisable to choose an alternative for gold investment. For example, opening a precious metals passbook account, also known as “Paper Gold”, to invest in gold and other precious metals. Or else you can also invest in gold-focused mutual funds and exchange-traded funds (ETFs).

Stocks

Investing in a diversified stock portfolio is another inflation-hedging approach. But, pouring money into the stock market, of course, doesn’t guarantee risk-free, but if you need to be patient enough and try to pick some blue chips with a strong reputation and reliability so that you can just hold it for a while before selling it off to make some gains. For such, you may consider choosing an ESG (Environmental, Social, and Governance) fund since many conglomerates care about the environment nowadays, so you can tell ESG is a trend. In addition, technology, other growth stocks, consumer goods companies, and others in the defensive sector are also worth noting since these industries are thriving and you can expect some good results over time.

Real Estate

If possible, buying property is always the best investment option. Once you own a property, you can rent it as the housing price continues to rise, so that you can make a fortune. However, if you have limited capital, you may consider investing in Real Estate Investment Trust (REIT) since it is a collective investment scheme that aims to deliver a source of recurrent income to investors through focused investment in a portfolio of income-generating properties such as shopping malls, offices, hotels and serviced apartments in the local or oversea markets. Basically, you don’t physically own the real estate, but you will receive regular income distribution from REITs should the property values increase over time. A majority of REIT’s net income after tax is paid in a form of dividends.

Alternative investments

You may also consider investing in luxury items like Rolex, Gucci, Tiffany & Co., or you can purchase others with intrinsic values including fine arts, vintage cars, and collectibles. Although it’s hard to predict their prices in the future, the value of these items is expected to appreciate over time. Besides, you may also consider buying cryptocurrencies, like Bitcoin (BTC) and Ether (ETH), and NFTs, since these new digital assets are used to hedge inflation in recent years.

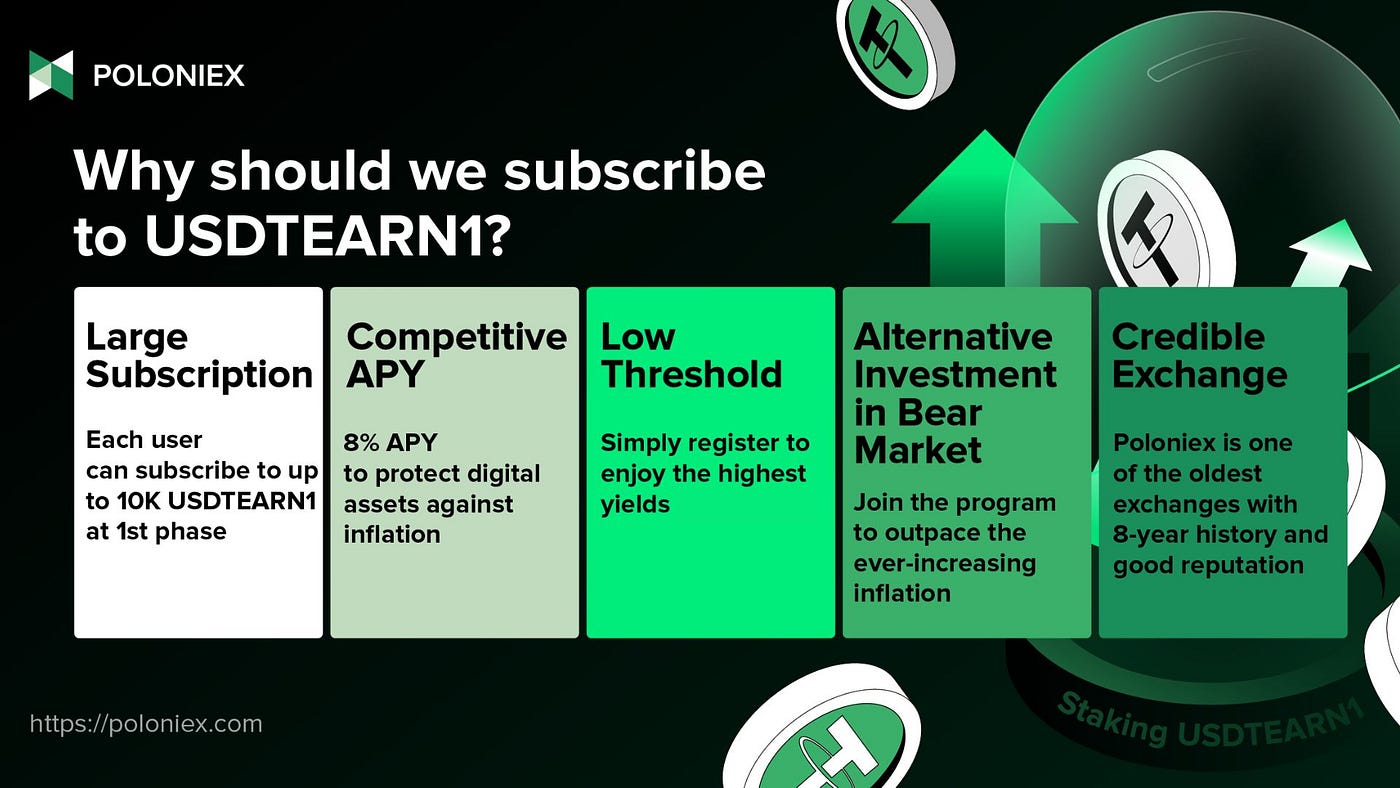

As these digital assets are maturing that the crypto market can be very volatile, so if you are curious about this area, yet you are also a conservative investor, you may consider joining Poloniex’s newly launched program, dubbed Poloniex EARN, to grow your crypto holdings in a fixed term to protect your digital assets from being eroded in the high inflation.

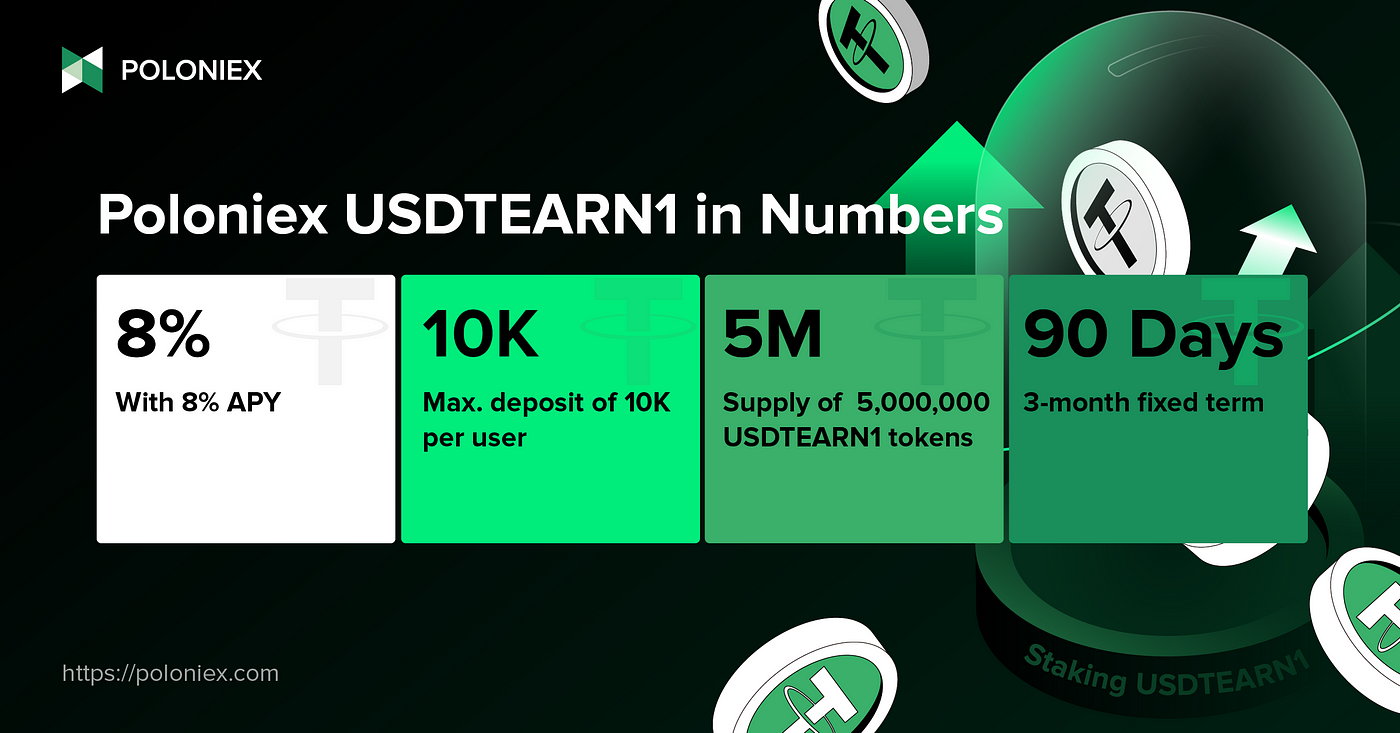

The first leg of the programe, named USDTEARN1, commenced on September 26, 2022 with a total supply of 5,000,000 USDTEARN1. Each user is allowed to subscribe to up to 10,000 USDTEARN1 and to lock the holdings in a 90-day fixed term with an APY of 8%. For more information, please visit Poloniex Support Centre.

In conclusion, all investments are subject to risk, investors are advised to consider the risk of assumption beforehand and the rule of thumb is always DYOR.

About Poloniex

Poloniex is one of the oldest cryptocurrency exchanges that allows you to buy or sell digital assets, such as Bitcoin (BTC), Ethereum (ETH), TRON (TRX), and other altcoins. Founded in 2014, security, new features, and user interface are some of their top priorities. The exchange guarantees that users will experience safety and security while conducting transactions.

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.