Bitcoin Jumps $400 As Bitmex Goes Into Maintenance, Bitcoin Shorts Reached All-Time High

Bitcoin pumped to a two week high suddenly from $6483 to over $6800 in less than an hour, which can be attributed to Bitmex going offline for maintenance.

Bitmex is a margin trading platform which has more volume than most Cryptocurrency exchanges, Bitmex was taken down for a couple hours on August 21st where the users could no longer log in and execute the orders which could be one of the main reasons for the recent pump.

Image Source: Coinmarketcap

As the traders were aware of the downtime earlier they took advantage of the situation. This just goes to prove how small and immature the market really is. We are still in the infancy of Cryptocurrencies and there still has to be a maturation of the market and more instruments like a Bitcoin ETF for it to happen.

Joseph Young Tweeted:

If bitcoin increased by 4% overnight because of scheduled maintenance of BitMEX, then the crypto market really needs a lot of work to build solid infrastructure. One exchange can’t have majority of market share of any trading pair because it leads to instability / manipulation.

Bitcoin Shorts Reaches All-Time High

Bitcoin shorts have been on the rise in the recent past reaching its all-time high yesterday worth over $260 Million (39000 BTC) surpassing the longs by a huge margin.

Image Source: Trading View (As of August 21)

The last time Bitcoin shorts had risen to All-time high’s we saw massive short squeezes, like in April where Bitcoin rose up to $10000 as the market pretty much ran out of sellers.

CryptoYoda Tweeted:

$BTC bears increasing positions while hidden buyer whale says no further. expecting turbulent moves as soon as one of them folds, almost there

Armin Van Bitcoin Tweeted:

https://twitter.com/ArminVanBitcoin/status/1031952723288236032

The Bitcoin ETF Situation

One of the reasons for the rise in the shorts is in the anticipation of Bitcoin ETF getting rejected by the SEC. The ProShares ETF is due on August 23rd where the SEC has to come to a decision and can no longer delay it, a lot of people are expecting this ETF to get rejected especially after the SEC expressed its concerns on market manipulation.

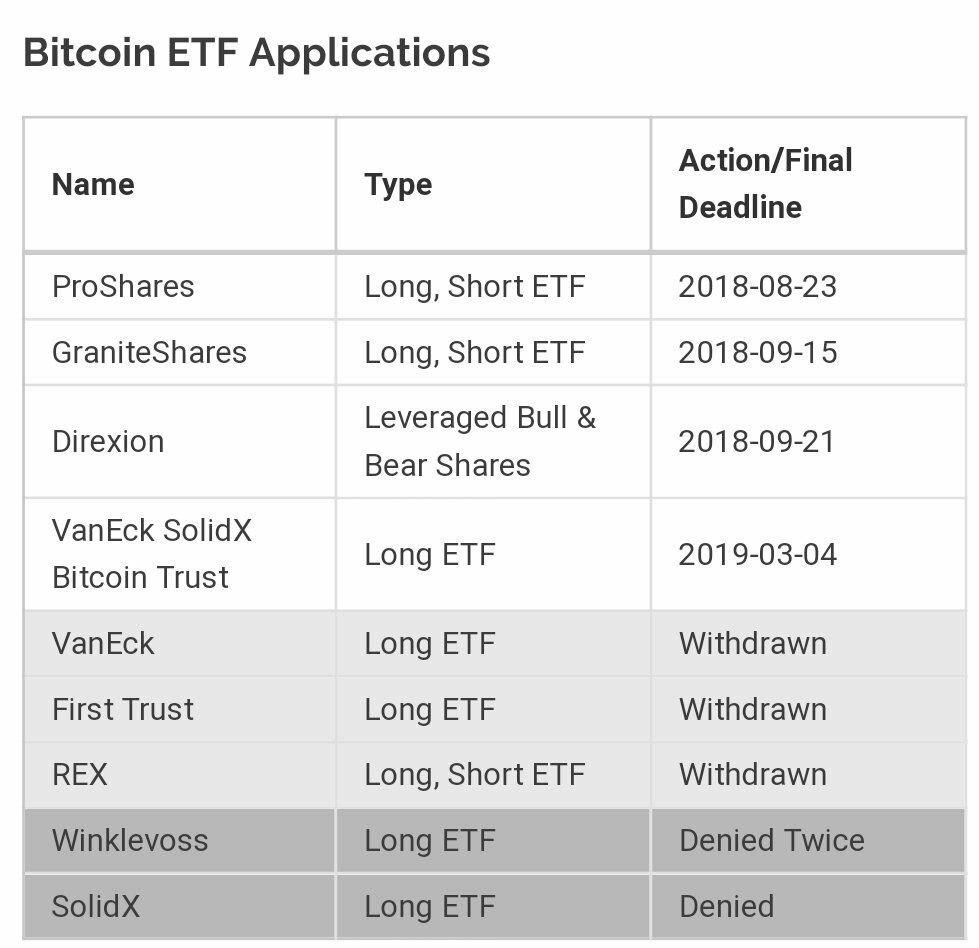

Here is a list of all the upcoming Bitcoin ETF’s:

Some people are hopeful for the Direxion ETF to be approved which is to be decided in September, but whether or not the ETF’s get approved or not the Crypto community are now excited for the launch of Bakkt, an exchange platform for Cryptocurrency in November.

The reason being Bitcoin will be fully collateralized and any kind of margin trading will not be allowed, this can be a good thing because first the product is launched by New York Stock Exchanges’s Intercontinental Exchange [ICE] which is a trusted institution by many and second there won’t be any margin trading in the platform which can be a good thing it won’t be catalyst for manipulation.

Although this raises the question as to whether we need institutionalized products for Bitcoin whose whole purpose is to provide economical sovereignty to the user. Although this is debatable, the introduction of such products will increase Bitcoin adoption and liquidity.

Alex Sunnarborg Tweeted:

11/ Products like Bakkt physical futures (cleared by ICE planned for Nov) & the XBT Provider ETN (now available via Fidelity) will only add further liquidity & infrastructure to the market in the coming months (to the detriment of less efficient options).

— Alex Sunnarborg (@alexsunnarborg) August 21, 2018

Also Read:

Bitmex CEO Predicts Ethereum To Fall Below $100 And Calls It A Shitcoin

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.