Bitmain has the potential to become the biggest cryptocurrency company, concludes BitMex Research

BitMex, the world’s most popular leverage trading platform, recently conducted a thorough research on Bitmain’s much talked IPO. In July, Blockmanity reported that Bitmain is looking to get itself listed on the Hong Kong stock exchange and is planning the biggest IPO in cryptocurrency history.

BitMex Research

BitMex conducted an internal research on the leaked financial data of Bitmain’s IPO. In the research, BitMex compares Bitmain to a gold mining corporation that invests in high priced assets in the bull market, but fail to invest quality low assets during the bear market. According to BitMex, Bitmain’s results are not new and are expected from any mining companies.

“Bitmain has the ingredients to be one of the great companies in the cryptocurrency space. Bitmain can be a legendary crypto company, generating strong shareholder returns for decades to come, but in order to achieve this (and it’s a lot harder than it sounds) the Bitmain management team may need to improve their management of company resources.”

Bitmain’s Problem

BitMex concluded in their research that Bitmain is currently loss-making, while it was profit making in the year 2017. One of the possible reason given by BitMex is due to the fact, the general demand for cryptocurrencies has gone down.

The three possible areas of concern for potential Bitmain investors outlined by BitMex are:

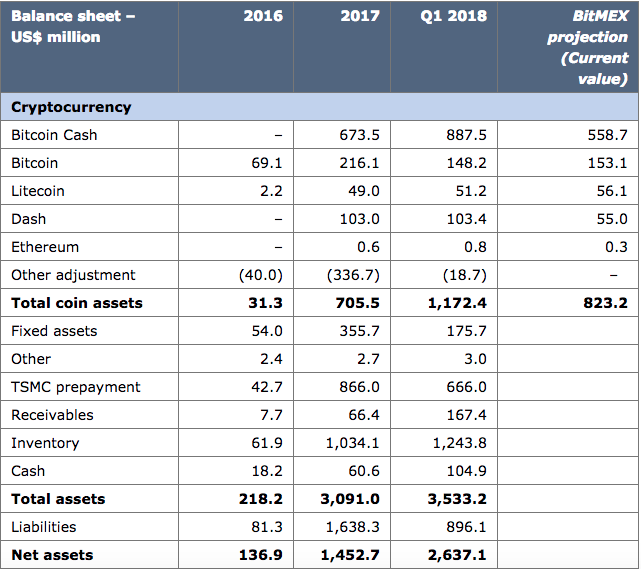

- Large prepayments to TSMC, totalling almost $866m in 2017, which weaken Bitmain’s working capital situation;

- A large inventory balance, of around $1.2bn (over 50% of peak annual sales) illustrating overproduction;

- A large portfolio of altcoins, with a cost base of $1.2 billion which represents the primary use of Bitmain’s cash flow.

Bitmain’s Balance Sheet (Copyrights BitMex)

The key portfolio of Bitmain consists of Bitcoin Cash, which has lost about 9 times its value since December 2017, while its rival Bitcoin only lost 3.5 times its December 2017 value.

Nvidia’s Pull from the Cryptocurrency Market

Nvidia had witnessed a massive growth in 2017 due to the rising profits from cryptocurrency mining. But since then profits have declined. Nvidia had projected $100 Million Q1 revenue from its cryptocurrency mining GPUs but the actual figure turned out to be around $18 Million.

Based on this, Nvidia made the decision to pull out cryptocurrency mining revenue from its budget. Nvidia pulling out of the cryptocurrency market leaves investors wondering on the future of mining.

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.