Crypto Security Firm Highlights Three Possible Outcomes for the BCH Hard Fork

As the day of the Hardfork of the Bitcoin Cash network arrives, the Crypto security firm PeckShield releases three possible outcomes of the BCH hard fork.

Current State of the fork

Bitcoin cash is currently priced at $429 with a market cap of $7.48 Billion at the time of writing. The futures price on Poloniex for BCH SV is currently $127 whereas BCH ABC is more than double the price at $286.

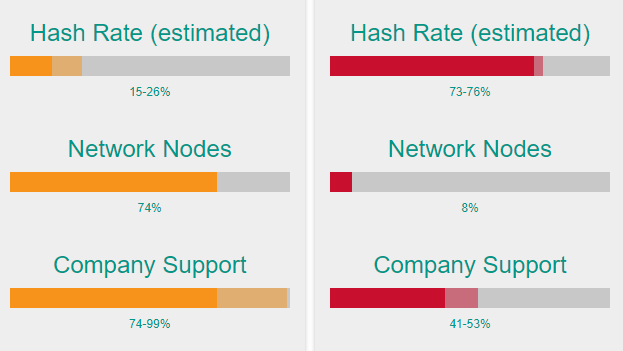

Craig Wright’s BCH SV is leading in the hash rate war with over 74% network hashrate mainly with the backing of CoinGeek which dominated almost 40% of the hashrate as estimated by CoinDance. But Bitcoin ABC leads the way with a majority of network nodes and community support.

The orange column represents the BCH ABC client and the red BCH SV client.

Image Source: cash.coin.dance

Three Possible Outcomes

The Security firm, PeckShield has previously identified hidden vulnerabilities, loopholes in EOS dApps and even defended against emerging threats. So it is safe to say that the company is reliable and insightful in its reports.

The firm has come up with three major outcomes of the fork which is scheduled shortly after 04:40 PM UTC on November 15, 2018.

1. Based on the existing hashrate, BCH SV may implement a 51% attack on BCH ABC, which may force BCH ABC to mobilize BTC hashrate to fight, and finally conduct the same attack in reverse, leading to a lose-lose situation;

Jihan Wu, CEO of Bitmain has declared full on war against Craig Wright’s SV client. He has promised to take any measures to prevent the downfall of BCH ABC client. Bitmain is the largest miner with the highest hashrate in BTC, some of it is likely to be transferred to BCH by Jihan even though it may cause a loss to the company.

2. One of the public chains, after the hard fork, may not be able to produce blocks steadily for a long time due to the lack of miners and users, and gradually disappear;

BCH ABC is leading the way in user support and the nodes running on the network. Craig can convince miners to join his network but it is harder to get users to use a Cryptocurrency.

3. The two public chains may operate independently, and meanwhile the existing BCH assets will have a significant change. BCH and its forked coins will fluctuate with a high probability in the short term, which may even induce general fluctuations in the industry.

The entire market took quite a hit yesterday wiping out over $30 Billion in market cap in a matter of hours. The month-long stability of the market was changed in a day, so even more volatility would not come as a surprise.

Also Read:

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.